Recent industry research involving 720 financial services professionals has highlighted a disparity between the intended culture of financial services firms and its practical application under the Financial Conduct Authority’s (FCA) Consumer Duty, as many firms admit they are still struggling to correlate their internal culture with customer outcomes.

Compiled from poll data taken during a recent webinar hosted by Elephants Don’t Forget and regulatory consultancy firm Ocorian, the findings suggest that while technical frameworks are largely in place, the connection between culture and Duty impact remains a significant challenge for firms to evidence.

Firms appear to be struggling to connect their internal cultural health directly to the “lived” impact on customer outcomes, as many expressed a sentiment that their “culture exists primarily on paper and does not consistently shape day-to-day decision-making.”

Furthermore, many firms expressed that they “lack credible evidence required to show that culture supports good customer outcomes in practice.”

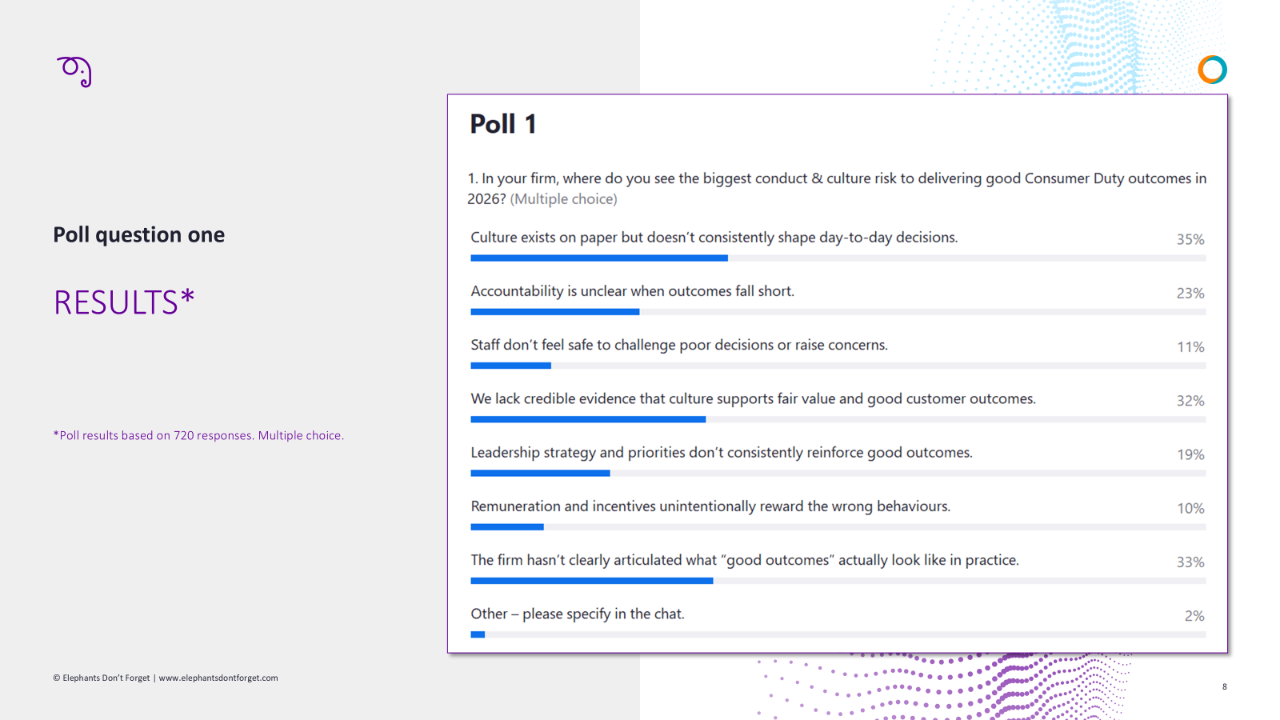

When asked, “In your firm, where do you see the biggest conduct and culture risk to delivering good Consumer Duty outcomes in 2026?” 35% of respondents identified the disconnect between “written” culture and daily decision-making as their most prevalent risk.

This internal friction was further exacerbated by a lack of clarity regarding practical application, with 33% of participants stating that they felt their firm had not yet clearly articulated what “good outcomes” looked like in practice.

32% of respondents admitted to a specific lack of evidence that their firm’s culture effectively supported fair value and good customer outcomes, highlighting a significant vulnerability as the FCA prepares to ramp up its focus on measuring the tangible impact of the Duty in 2026.

Additional research also brought to light several deeper concerns which suggest the Duty has yet to be fully integrated into the operational DNA of many firms.

The findings indicate that cultural friction is often rooted in a lack of clear accountability and a perceived misalignment between high-level leadership strategy and day-to-day execution:

- 23% of respondents said they felt that “accountability remains unclear when outcomes fall short.”

- 19% believed that leadership strategy and priorities did not consistently reinforce the Duty.

- 11% stated that “staff do not feel safe to challenge poor decisions or raise concerns.”

- 10% noted that existing “remuneration and incentive structures may unintentionally reward behaviours that do not align with positive consumer outcomes.”

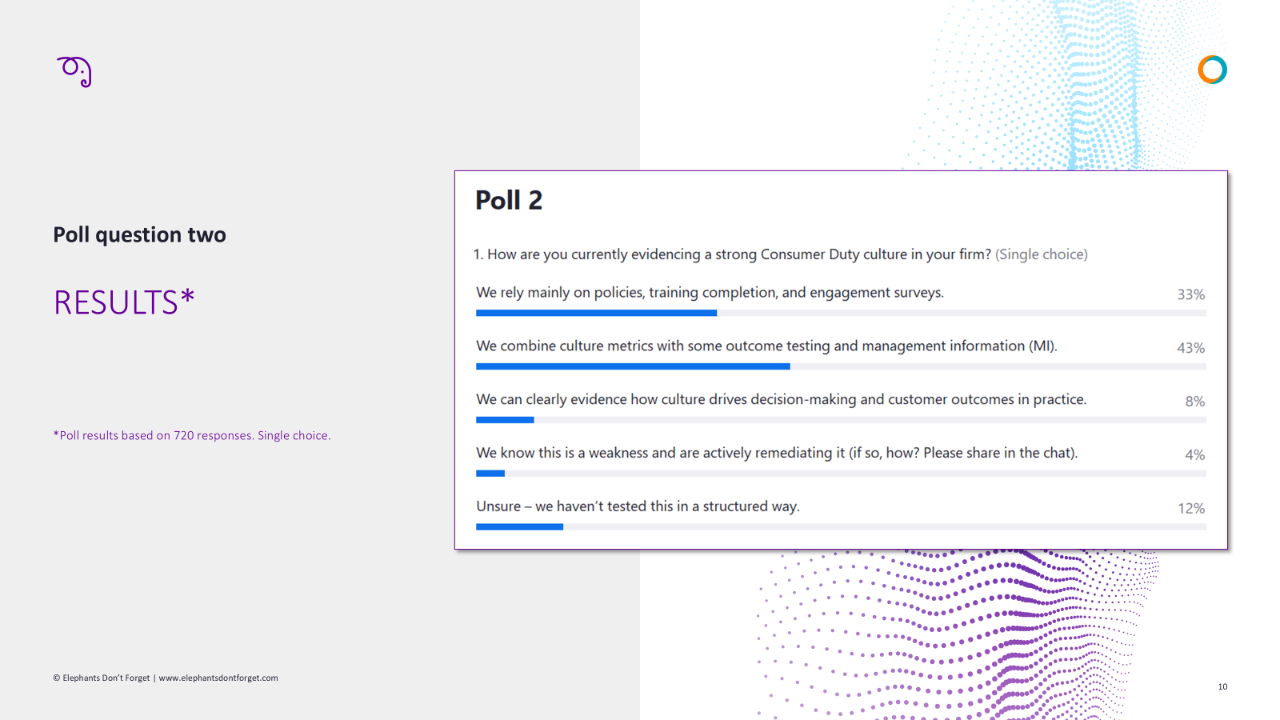

In a follow-up poll question, participants were asked: “How are you currently evidencing a strong Consumer Duty culture in your firm?”

While 43% of participants said they combined culture metrics with some outcome testing and management information, a third of respondents (33%) stated they mainly relied on policy documentation, training completion rates, and high-level staff engagement surveys.

Perhaps most striking was that only 8% of respondents stated they felt they could clearly evidence how culture drove decision-making and customer outcomes in practice, while a further 12% of professionals admitted they remained unsure because their culture had not been tested in a structured way.

Commenting on the findings, Adrian Harvey, Chairman and Co-Founder of Elephants Don’t Forget, said:

“The FCA’s Consumer Duty continues to put increasing pressure on financial services firms to further prioritise the need to deliver good customer outcomes.

Two critical factors in a firm’s response are their Consumer Duty culture and the competence of their employees. Yet, measuring, improving, and evidencing these remains a challenge.

The sentiment captured from our polls underscores a concerning reality for many firms: there is a significant gap between the desired cultural improvement the FCA is expecting to see and the one being lived in practice.

The Duty sets a higher standard of care across financial services, and culture is what makes that standard real in day-to-day decisions. While the technical foundations may be in place, the fact that only 8% of senior professionals said they can clearly evidence how their culture drives outcomes should be a wake-up call.

In November 2025, we were joined by Jonathan Pearson, Head of Department, Consumer Policy and Outcomes at the FCA. What was clear from our engagement is that, in 2026, the regulator is looking beyond ‘Are you compliant?’ to ‘Show us the outcomes.’ That is the shift. The regulator reiterated that the Duty is not a checklist, but a mindset to be lived every day.

Firms must foster an environment that aligns with continually supporting and improving their culture and people. Competence is not a static, one-off achievement; it requires a commitment to ongoing learning and an agile willingness to adapt. The Duty must be driven by highly competent, customer-facing staff, underpinned by a genuinely customer-centric organisational culture.

As we move into the next chapter of the Duty, firms should be asking themselves: How effectively have we translated high-level values into day-to-day behaviours? How do we measure these? And, crucially, how can we better demonstrate that employee competence is a continual process of learning and regular reflection that supports a customer-centric culture in practice?”

Further resources

- Learn more about our latest product offering: Consumer Duty Insight (CDi). Created in collaboration with industry experts, CDi continually diagnoses, embeds, and benchmarks an organisation’s end-to-end Consumer Duty culture and competence programme.

- Watch our recent webinar – Kick-Start 2026: Conduct, Culture & Consumer Duty – What Firms Must Get Right, hosted with Ocorian.

- Find out more about our engagement with the FCA in our interactive e-book, which discusses the critical importance of cultural improvement, employee competence, and what the next chapter of the Consumer Duty means for firms.